Allegory of the Dam

An extended metaphor on water, pickaxes, and cargo culting

An expanded metaphor

Say there's a dam in a Mad Max world. You need a lot of people to hammer away at the dam to break it so that we don't die of thirst, so people start making pick axes.

— Keeks (@Nogoodtwts) December 4, 2019

Imagine a world where water is essential and more limited than this world. Something like Mad Max, where water is a precious commodity . The water is held behind dams, and you don’t know how much effort it takes to break a given dam, nor do you know how much water is behind the dam. So, people conclude the best way to get the water is to have a lot of people chipping away at the dam. In order to not have everyone die of thirst, people go from punching the dam, to throwing rocks, to making and using pick axes.

This world is a weird one, so some dams are made of different materials, and sometimes you have to make a special pickaxe for a given dam. The people who made the pick axes don’t want you to die of thirst or get burnt out on pickaxing, so they sell you a pail to catch some water if you help break the dam. It’s like that video game that was oddly very similar to Bitcoin mining (but dissimilar because the game developer burned through the money they received, and didn't fulfill their promises). Some people look at the pickaxers, saying:

“At this rate, there will be so much water! I don’t really need to pickaxe, I can’t keep up with these youngin’s, and from an opportunity cost standpoint it’s more profitable to catch and sell the water to people pickaxing different dams. Lemme buy 800 water pails and set up shop on this section of riverbed.”

Let’s call these water brokers Basins, because they collect water like a basin. Soon, a number of other potential and current pickaxers come to the same conclusion, and follow suit. The Basins take funding, preach the gospel of a hydrated future, get people to buy pails and pick-axes tied to a given Basins’ lot.

But the dam hasn’t broken yet!

The people hammering away are looking back at all the Basins, thinking:

"Am I the sucker? I can only catch a week's worth of water with this pail, and I lose 30% of the water I collect to the Basins!"

Some get funded by Basins to set up stations right next to the dam. More people start to give up or set up a Basin, but there are still some people hammering away. People who analyzed previous dam breaks try overfitting their analysis to this specific dam:

“Alright, of the last 423 dams were broken, 45% of them broke at 5:17PM EST on a Wednesday. I remember hearing from someone that a dam is weakest 40 meters from the center, so if we strike the ground 40 meters from where everyone’s chipping at 5pm EST on Wednesday, we will have w a t e r “

So people are trying to reproduce the variable present at the last dam breaks, despite the possibility that the variables being reproduced might not be as heavily correlated as they hope.

The inventors who developed the technology and techniques that led us to this extended metaphor did not commercialize their work. In the efforts to not die penniless, they start raising money for their own Basins and proprietary axes, hoping to break some other section of the dam.

So we have a bunch of people still cracking away at the dam, doing the Universe’s work of focusing their efforts on freeing up water trapped behind the dam. But a growing number of people conflate the phrase “dams can be broken” with “dams will be broken;” as a result, many people try to maximize their personal/group profit in lieu of maximizing the chance of any profit for all participants in this exercise.

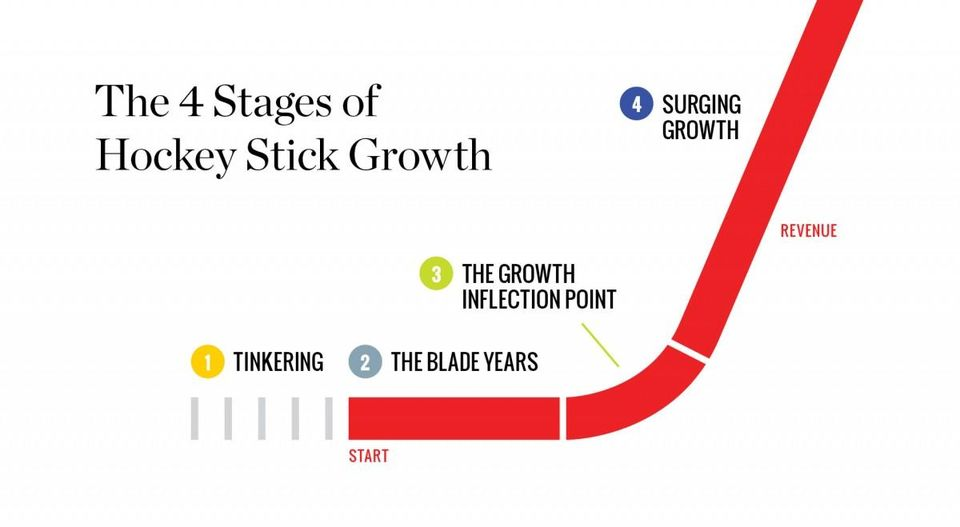

The water in this metaphor is money (think "liquidity"). The dam is the mythical “mass adoption” moment (0–1, or a chasm), and breaking that dam is crossing that threshold and achieving hockey stick growth.

A given dam can be seen as a market, pickaxers can be seen as companies attempting to tap into new markets, and Basins can be seen as their investors, advisors, or supporters. There’s an argument that because we don’t know how much water is behind the dam until it’s completely been broken, that markets can quickly run dry.

With most historic innovations, product-market fit drove innovation and new industries. In the case of the Crypto Dam, Satoshi arguably found and broke a chunk of the Dam with Bitcoin. I believe that Bitcoin had product-market fit among a group of market participants with the skills and agency to improve the product. The fact that Satoshi disappeared adds to the agency and potential immortality of the project: if they were a public figure, they’d have been arrested/disappeared. If we contrast that with the many public-facing figures who developed the academic techniques (, zero-knowledge proofs, one can see how and why they’d throw their hat in the ring in order to contribute to society and receive compensation. Otherwise, people are getting rich off of their academic labor.

Basins (funds) are pools of money with fiduciary duties and compensatory incentives to make a return (in most cases). As such, it gets tricky (read: lawsuit-worthy) to justify people building a really interesting distributed ledger if there isn’t a reasonably certain value accrual mechanism. FOSS is hard to monetize, and equity is reasonably illiquid when you look at tokens. As such, investors are incentivized to invest in tokens, as they don’t want to get sued for breach of fiduciary duty. While it’s easy to reduce the efforts that investors and funds play in the metaphor and in modern markets, real-world innovation and metaphorical damn breaking would move at a snail’s pace without pickaxers (builders, entrepreneurs, FOSS developers and maintainers, etc. unlocking value) being funded.

When a number of people have created post-threshold companies before the threshold has been crossed, we run the risk of the threshold never being crossed. This is because focusing on building post-adoption products and services implicitly draws efforts away from the chance that the dam is never broken. Optimizing for upside instead of recognizing that the “mass adoption” moment isn’t a given stands to ruin a lot of people’s efforts. As a result, the industry would devolve into a cargo cult. Basically, a cargo cult is when a group of people attempt to replicate a good thing by ritualizing the wrong cause. From the Smithsonian:

The island’s John Frum movement is a classic example of what anthropologists have called a “cargo cult”—many of which sprang up in villages in the South Pacific during World War II, when hundreds of thousands of American troops poured into the islands from the skies and seas. As anthropologist Kirk Huffman, who spent 17 years in Vanuatu, explains: “You get cargo cults when the outside world, with all its material wealth, suddenly descends on remote, indigenous tribes.” The locals don’t know where the foreigners’ endless supplies come from and so suspect they were summoned by magic, sent from the spirit world. To entice the Americans back after the war, islanders throughout the region constructed piers and carved airstrips from their fields. They prayed for ships and planes to once again come out of nowhere, bearing all kinds of treasures: jeeps and washing machines, radios and motorcycles, canned meat and candy.

In this Allegory of the Dam, the people misattribute a desired outcome (say, value accrual) to the wrong preceding event or cause (say, press releases about partnerships, in lieu of quantifiable product-market fit). The myth of John Frum is somewhat similar to the myth of Satoshi, and in the process of creating etiological myths, people tend to heavily weigh concepts that fit into their worldview over ideas that contradict their perspective. And so, there's always a chance that the people surrounding the Dam never break it.

That said, a lot of folks don’t really know what they could do to crack the dam, and when you don’t fancy yourself an optimal pickaxer, you’re incentivized to operate on the assumption that the pickaxers will succeed. If you’re in the position of a Basin, maybe the best thing you can do is find and coach good teams of pickaxers while trying to make your investment of other people’s money profitable.

Like most things, it’s a system of incentives. Most importantly, in the case of the Crypto Dam we should continue to support the entrepreneurs actively developing use cases that show consumers the power of censorship-resistant and distributed technology. The more entrepreneurs we fund, the higher the chance that the hurdles to widespread use are surpassed, and the sooner the world can reap the benefits.